– Ad –

| Getting your Trinity Audio player ready... |

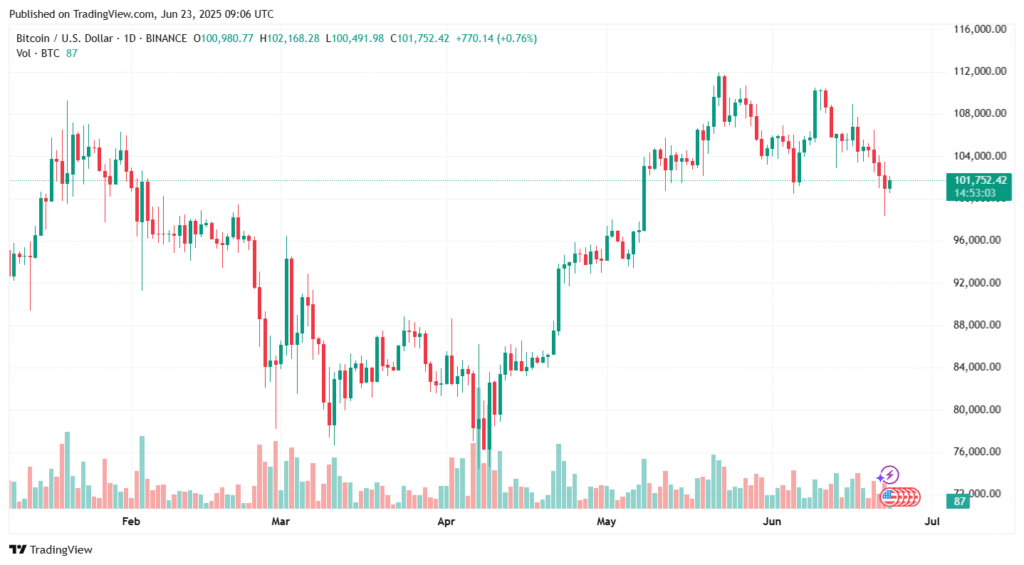

On June 22, 2025, the cryptocurrency market faced a dramatic upheaval when U.S. President Donald Trump announced targeted airstrikes on Iranian nuclear facilities at Fordo, Natanz, and Isfahan. The geopolitical escalation triggered a massive sell-off, with Bitcoin dropping below $99,000 and over $1 billion in daily liquidations rattling the crypto world. This article briefly examines the causes of the crash, its impact, and the market’s tentative recovery.

U.S.-Iran Conflict Sparks Crypto Turmoil

The U.S. strikes, aimed at curbing Iran’s nuclear program, sent shockwaves through global markets. Iran’s threat to block the Strait of Hormuz—a critical oil chokepoint—raised fears of soaring energy prices, prompting investors to abandon high-risk assets like cryptocurrencies. According to CoinGlass, the crypto market saw $1.03 billion in liquidations by midday Sunday, June 22, 2025, with long positions taking the brunt. Bitcoin plummeted, Ethereum fell 10% to $2,171 (its lowest since early May), and altcoins like Solana, XRP, and Dogecoin suffered double-digit losses. The sudden shift in sentiment highlighted crypto’s vulnerability to global crises.

The crypto market’s round-the-clock trading intensified the sell-off, with panic spreading more rapidly than in conventional markets. Iran’s vow to retaliate, coupled with uncertainty over oil supply disruptions, drove investors toward safe-haven assets like gold, U.S. Treasuries, and the dollar. This “risk-off” mood was a key driver of the liquidations, as traders scrambled to exit volatile positions.

Why Crypto Markets Are So Volatile

Cryptocurrencies are inherently sensitive to external shocks due to their speculative nature and lack of centralized regulation. The U.S.-Iran tensions acted as a catalyst for the crash, but the scale of liquidations was magnified by leveraged trading. Many traders use borrowed funds to amplify bets, but when prices drop sharply, exchanges force-sell these positions to cover loans, triggering a cascade of sales. This leverage effect turned a market dip into a $1 billion rout.

Additionally, crypto’s global accessibility means news spreads instantly, fueling rapid price swings. Unlike stocks, which have trading halts, crypto markets react in real-time, making them prone to overreactions. The Iran strikes, combined with fears of economic fallout, created a perfect storm for the market’s collapse.

Recovery Signs and Investor Strategies

By late Sunday, June 22, 2025, the market showed early signs of stabilization. Bitcoin rebounded to slightly below $101,000, and Ethereum rose to approximately $2,200. However, analysts warn that volatility may persist until U.S.-Iran tensions ease. Iran’s potential response, including disruptions to oil flows, remains a critical factor. If tensions escalate, crypto could face further pressure; if de-escalation occurs, confidence may return.

For investors, navigating this uncertainty requires caution. Avoiding excessive leverage, diversifying portfolios, and staying updated on geopolitical developments are essential. Some traders view the dip as a buying opportunity, citing crypto’s history of rebounding from crises. Others, wary of prolonged conflict, are holding off until the situation stabilizes. The market’s resilience has been tested before—such as during past geopolitical flare-ups—but its recovery hinges on global stability.

Also Read: Crypto Chaos: $650 Million Wiped Out in 24 Hours

Final Thoughts

The $1 billion crypto liquidation underscores the market’s fragility amid geopolitical shocks. While Bitcoin and other assets show tentative recovery, the U.S.-Iran conflict’s outcome will shape the market’s trajectory. Investors must stay vigilant, balancing opportunity with caution in this unpredictable landscape.

FAQs

What caused Bitcoin’s crash after the U.S. strikes on Iran?

The strikes sparked fears of conflict and oil supply disruptions, driving investors from risky assets like Bitcoin to safer options.

How much was liquidated in the crypto market?

Over $1.03 billion in positions were liquidated on June 22, 2025, per CoinGlass, mostly impacting long trades.

Should I buy Bitcoin after this dip?

It depends on your risk appetite. Dips can be buying opportunities, but ongoing U.S.-Iran tensions may drive more volatility.